- Essay

- Term Paper

- Research Paper

- Book Report

- Book Review

- Coursework

- Research Proposal

- Annotated Bibliography

- Test

- Answers Questions

- Multiple Choice Questions

- Dissertation

- Thesis

- Formating

- Editing

- Proofreading

- Rewriting

- Revision

- Powerpoint Presentation

- Poster Presentation

- Excel Exercises

- Thesis Proposal

- Case Study

- Discussion Board Post

- Dissertation Abstract

- Dissertation Introduction

- Dissertation Literature

- Dissertation Hypothesis

- Dissertation Methodology

- Dissertation Results

Introduction

The question of price discrimination involves quite a high degree of development of market relations. Occasional, incidental, transactions between buyers and sellers replacing each other have been always committed at different prices, on which the participants were able to agree. Only over time, there have appeared conditions for the formation of what would be called a single price of the commodity market. This requires shaping a specific economic area with a relatively stable structure of transactions participants. On this ground, the main reason equalizing prices is competition. Vendors compete by offering customers the best alternative. Buyers compete with each other as well. They are fighting not only for goods but the most favourable conditions for its acquisition. As a result, the market has to trade at about the same prices.

All that could undermine any direction of competitive relations, as well as divide a single competitive space, creates the conditions for price discrimination. Price discrimination occurs on the basis of real contradictions of the market mechanism. One of the features of its operation is to bring all the individual assessments and capacity to a single more representative average level. All are equal on the market. However, a set of different values of individual evaluations of consumers with different budget possibilities underlies the general demand curve. This means that if a single market price is set, there are always buyers ready to pay more for the same amount of goods. In addition, if the price were higher, consumers would not refuse from purchasing the product. In such a case, they would buy fewer amounts of goods. Therefore, buying more at a given price is as if they are underpaying for the previous goods items.

Purpose of Price Discrimination

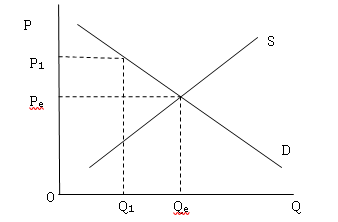

One of the main assumptions of the economic theory is that each market entity acts in its own interests and seeks to maximize its own benefits. Each company aspires to its profit maximization. Usually, the company sets one price for the whole output of the product. However, the opportunity to increase the profit suggests another policy. The graph of the market equilibrium shows that there are buyers willing to buy goods at a price higher than the equilibrium price.

Figure 1. The market equilibrium

If there are consumers that would pay the price P1 for the product, then the company would be happy to sell it at this price instead of the equilibrium price Pe. At the same time, if the firm changes the price for the whole amount of goods, it loses consumers who do not want to buy them at a more expensive price. At the price P1, the firm may only sell the goods quantity Q1 instead of Qe. This implies that the company can significantly increase its revenue if it can sell each unit of goods at the highest price, at which consumers are willing to buy it. If the company could sell some goods at P1 and then lower the price to Pe, then its profit would be significantly higher.

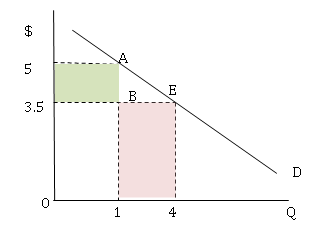

Figure 2. Revenue comparison

As seen in the Figure 2, at P1 as the general price, the company revenue includes the area P1AQ10. At Pe as the general price, it includes the area PeEQe0. In other words, the firm revenue increases in the area BEQeQ1 and decreases in the area P1ABPe. Only if the firm is able to implement different prices for the same product, it can receive the revenue from both areas mentioned avove.

The company may also expand the range of its consumers by lowering prices for those who cannot afford the goods at the equilibrium price. Under normal conditions, such a decision would be unprofitable for the company as it should have sold all the products at the lower price. However, if it could change the price only for those customers who would not buy the product in another case without changing it for the rest, then the firm would expand its market share. Moreover, by producing a higher amount of goods, it could benefit from the economies of scale.

Figure 3. The effect of lower price segment on the firm revenue

For the sake of maximizing profits, companies seek to sell the same product to its customers at different prices. Such a policy is the price discrimination under the condition that differences in prices are not related to the cost.

Price Discrimination of Second and Third Degree

There are three types of price discrimination. Ideally, the company would prefer to assign a special price for each individual customer. If it were possible, each consumer would pay the maximum price that he or she is willing to pay for each unit of the goods sold. That would be the price discrimination of the first degree. It is an absolute, perfect price discrimination which implies the individual prices for each customer.

On some markets where the buyer acquires large amounts of goods for a certain period of time, its demand reduces proportionally to the amounts of purchased goods. In this situation, the company can introduce discrimination in accordance with the consumed amount of products. It is called the second-degree price discrimination, and it consists in assigning of different prices depending on the quantity of the same product or service. This method uses a decreasing demand curve. It reflects a decrease in consumers’ willingness to pay, depending on the increase in sales volumes.

An example of price discrimination of the second degree is a discount for the purchased amount. One photo film is worth $5, whereas the container with four identical films will cost $14. The average price of the film drops to $3.50.

Figure 4. A discount for the purchased amount

In this example, the firm divides its customers into two groups, depending on the quantity of goods purchased, and sets two different prices for them. In this way, the company sells part of its products at the higher price and part of the goods at the lower one. It is not difficult to determine the customer’s willingness to pay. They do this on their own by choosing the amount of the product that they are willing to buy.

A well-known company that produces drinks sets prices for its products in some unusual way. The company produces a drink that is advertised as one of the softest and most delicious among the existing. They sell this drink for $3 per bottle. However, part of the same beverage is bottled under a different name and sold for $2 per bottle by the same company. This company is practicing the third-degree price discrimination, and it does this because this practice is profitable for the company.

This form of price discrimination divides consumers into two or more groups with separate demand curves for each group. This is a common form of price discrimination, as evidenced by numerous examples: regular and “special” fares on airline tickets; brand high-end and lower class alcoholic beverages; canned food or frozen vegetables; discounts for students and elderly people, and so on.

Conditions

In order to implement price discrimination, it is necessary to satisfy the following conditions.

Firstly, the retailer should be able to control the prices. The easiest way is if it can become a monopolist. Therefore, the consideration of price discrimination is usually conducted in the context of a monopolistic market structure. The priority is to make sure that competitors cannot sell the goods cheaper in the region where the company intends to sell them at a more expensive price. Power over prices is also related to the number of buyers. If there are few customers, the withdrawal of any of them from the market is significant for the seller; consequently, the price dictation capabilities are limited.

Secondly, the buyers should not be able to purchase in the areas where the products are sold cheaper. The limiting of the ability to buy goods at a lower price is achieved in different ways. On the services market, there is a natural boundary separating buyers. A person cannot re-sell his own haircut or the healing from some disease at a reasonable price. On the commodity markets, if the geographical distance does not stop dealers or consumers, artificial limitations of resale can be used, for example, customs barriers.

Thirdly, the cost of implementing discriminatory policies should not exceed the benefits from such an activity. Bargaining with each customer individually, examining his or her solvency, controlling staff that has received an opportunity to set prices, and many other are expensive and not always justified.

Another condition is that the company should determine a sign by which it can divide its customers into certain groups according to their willingness to pay. Pricing depends not only on the interests of the monopolistic seller but also on how customers evaluate various products. As far as different customers’ opinions are concerned, the same thing has different utility. Therefore, the prices that they are willing to pay for it may differ. Because of the diversity in their tastes and preferences, the various groups of customers present a demand of different elasticity.

In each case, in order to break consumers into certain groups, the company uses some special characteristics. For example, for many products, students and senior citizens are willing to pay on average less than the rest of the population because of their lower incomes. Belonging to a group can be easily verified by a college certificate or driver’s license. Similarly, to separate vacationers from those who travel on business, in which case companies are usually willing to pay higher fares for tickets, airlines can set limits on special tickets at low prices. Many consumers are willing to pay extra money for the brand name, although there are goods of a less prestigious trademark that are identical or almost identical to it and, in fact, are sometimes issued by the same company that produces the finest quality brand.

For example, there is a firm that is seeking profit maximization and supposedly provides computer services: programs installing, curing of computer viruses, optimization of operational system work, changing of the broken details, etc. If there are thousands of similar firms in the market, then this particular company will not be able to affect the price. If it increases the price for its services, its customers would rather receive it from another company that sets lower prices than pay more. If the company reduces the price, then it will receive less revenue than costs. This would be unprofitable. Therefore, the only way to affect the prices is to work in a non-competitive market. The fewer competitors the firm has, the more price control it receives. If it is the only firm in the town with such a product, then it can set any price that it would like.

Supposedly, the firm has sold all its output at the same price. In order to maximize profits, it set the price Pe and the corresponding volume of issue Qe, at the point of intersection of the curves of marginal costs and marginal revenue. Although the company, in this case, would have received a profit, its managers are still willing to learn how to make the company more profitable. They know that some buyers are willing to pay more than Pe. However, raising the price would mean the loss of the buyers, decline in sales, and a smaller income. At the same time, other potential buyers refuse to purchase services of the company as the price Pe is too high for them. However, many of them would have paid for the goods an amount that is higher than the marginal cost of the firm. The company could sell the product or service to some of these consumers by reducing the price. Unfortunately, in this case, it would have received a lower income from the existing customers, and profits would have slipped again.

Figure 5. Withdrawal of consumer surplus

Ideally, the company would like to set a higher price for consumers willing to pay more than Pe, thus taking part of the consumer surplus in the area A of the demand curve. It would also be glad to sell services to consumers who agree to buy them only at a price lower than P *, not reducing it for other consumers. In that case, the firm would receive a part of the surplus in the area B on the demand curve.

As the firm has enough power to control the prices, it may implement price discrimination. It may sell its product cheaper to one customer and more expensive to another. However, if the first customer has the opportunity to resell the product that he bought cheaper, then he becomes a competitor. The first customer may buy more goods and sell them to the customers that may buy the same items at a higher price from the company. This reduces the price control by the company and makes price discrimination impossible. Nobody wants to buy the same thing at a higher price if there is an opportunity to buy it cheaper. Therefore, it is very good for the company in the example that sells services and not goods. Unlike goods that a person can take and give to somebody else, services cannot be re-sold. Now, the firm should decide how it will divide its customers into the groups. Supposedly,, it provides a 5% discount for buying 3 to 5 services and 10% for buying more than 5 services. In other words, the price is lower for those customers who buy more services. This is the price discrimination of the second degree. Fortunately, this type of price discrimination does not require bargaining and examining of the customers’ solvency. The customers decide to what group they belong and what price to pay by choosing the amount of services.

Figure 6. Price discrimination of the second degree

To different quantities of the same services different prices are assigned. In this case, there are three blocks with corresponding prices P, .95P, and .9P. Price discrimination of the second degree improves consumer welfare by increasing the volume of production.

Supposedly now, the firm would like to divide its customers into two sections and use the groups as a criterion for price discrimination. Supposedly, a service cross flow from one segment to another is not possible. Figure 6 reflects the demand for the services of a monopolist on the part of customers with more and less elastic demands. Implementing discrimination on the segmented market, monopoly maximizes profit by choosing the best combination of price and sales volumes in each of the segments, which differ from each other by the elasticity of demand.

Figure 7. Price discrimination of the third degree

The monopolist receives the maximum profit at the production volume in which the MR∑ = MC. Under the third degree price discrimination, the firm must allocate this amount between the segments of the market. The most profitable is a distribution type in which MR1 = MR2 = MR∑. The company maximizes the total profit by selling Q1 of its services in the first segment of the market at the price P1 and Q2 in the second segment at the price P2. The price set by the monopolist in the segment with a more elastic demand is lower than the price in the segment with a less elastic demand: P1

Conclusion

Price discrimination is an effective strategy for monopolist’s profit maximization. It is used because of the different demand elasticity of various groups of customers. If the elasticity of demand for all segments is identical, then the prices charged by the monopoly will be the same. In other words, price discrimination is meaningless for the profit maximizing monopolist. Therefore, different elasticity of demand for various segments of the market is an essential condition to implement price discrimination.

Monopolistic dictates work against the interests of consumers. It leads to the social loss related in particular to the sales reduction. However, price discrimination makes possible the increase of production, bringing it closer to the competitive level, thus encouraging the consumption. Moreover, it makes some goods and services available for the less secured groups of population.